What You Need to Know About Cryptocurrency Forks in 2024: A Comprehensive Guide

What You Need to Know About Cryptocurrency Forks in 2024: A Comprehensive Guide

A “fork” in the cryptocurrency realm refers to a change or modification in the underlying code of a blockchain protocol. When a blockchain’s code is altered, creating a split, it results in a fork, and thus cryptocurrency forks are created.

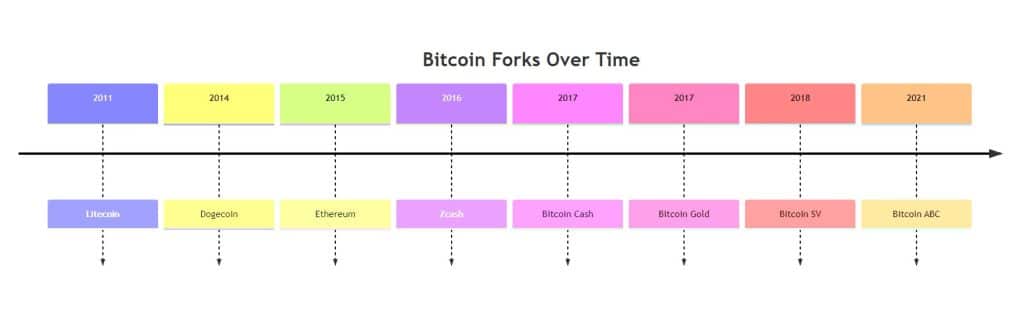

Especially Bitcoin forks are significant events because they can result in the formation of new cryptocurrencies and sometimes indicate substantial alterations to the protocol. Over the years, numerous developers have tried to hard fork the Bitcoin protocol, either to address perceived shortcomings in the original system or for personal gain. There have been dozens of Bitcoin hard forks, yet none have managed to sustain the longevity of the original.

The forthcoming Bitcoin halving is set to occur at block 840,000, which is forecasted to happen on 25 April 2024 at 07:55:06 AM UTC. On the date of the Bitcoin halving, the block reward is planned to decrease from 6.25 Bitcoin per block to 3.125 Bitcoin per block.

Here’s a list of the past Bitcoin forks.

There are two primary types of forks: hard forks and soft forks. Here’s a breakdown:

Hard Fork:

- A hard fork is a radical change to the protocol, making previously invalid blocks/transactions valid or vice-versa. This type of fork requires all nodes or users to upgrade to the latest version of the protocol software.

- It creates a permanent divergence from the previous version of the blockchain, adding a new rule to the network that isn’t compatible with the older network.

- Examples include Bitcoin Cash forking from Bitcoin and Ethereum Classic forking from Ethereum.

Soft Fork:

- A soft fork, on the other hand, is a backward-compatible change to the protocol. Even non-upgraded nodes can still validate transactions, although they may not recognize the new rules.

- It’s considered to be a temporary split in the blockchain as eventually, all nodes are expected to upgrade to the new rules, and the forked-off blocks will be abandoned.

Importance of Cryptocurrency Forks:

- Innovation and Improvement: Forks allow for the implementation of new features, fixing of bugs, and upgrading of security protocols. They help in maintaining the health and functionality of the network.

- Community Consensus: Forks often arise from disputes within the community on how to tackle issues or improve the network. They can lead to the creation of new cryptocurrencies when different factions decide to go separate ways.

- Adaptation: Cryptocurrency networks need to adapt to emerging technologies, security threats, or new industry standards. Forks enable this adaptability, ensuring the network remains relevant and secure.

- Decentralization: Forks embody the decentralized nature of blockchain technology. They reflect that there isn’t a single entity in charge, and changes can be proposed and made by the community.

The importance of forks is highlighted even more today as the cryptocurrency and blockchain sector matures. As various networks strive to enhance their functionality, security, and user experience, forks become a crucial mechanism for these improvements. Additionally, as blockchain technology finds applications across various sectors, the ability to fork and adapt the protocols becomes vital for addressing specific use cases and challenges.