MicroStrategy Funds New Bitcoin Buying Spree With Debt Financing

MicroStrategy Funds New Bitcoin Buying Spree With Debt Financing

MicroStrategy, a prominent global provider of software platforms, has purchased a significant amounts of Bitcoin, totaling $632 million. Founder and CEO Michael Saylor seemingly has a big confidence in the future growth potential of the leading cryptocurrency, despite its soaring prices.

With over 214,000 BTC now on its balance sheet, valued at approximately $7.5 billion, MicroStrategy holds more than 1 percent of all Bitcoin in circulation. Saylor’s conviction in Bitcoin’s long-term viability as a store of value has led the company to double down on its investments, with an additional $1 billion worth of Bitcoin acquired just this year, following a similar purchase in the fourth quarter of 2023.

The impact of MicroStrategy’s Bitcoin acquisitions extends beyond its balance sheet, influencing investor sentiment and driving the company’s stock price higher.

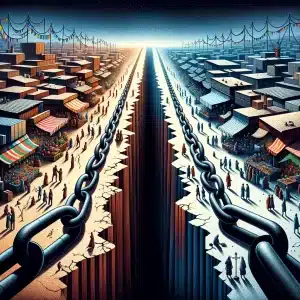

Debt financing to fund Bitcoin purchases poses a risk for MicroStrategy

However, concerns linger regarding the sustainability of MicroStrategy’s aggressive Bitcoin-buying strategy, particularly its reliance on debt financing to fund these purchases.

Analysts from JPMorgan have cautioned against the risks associated with MicroStrategy’s approach, referring to the potential implications of a significant downturn in the Bitcoin market. Surprisingly JPMorgan seems to forget that the company’s first purchase of $3.98 billion in Bitcoins, with an average cost of $30,639 per Bitcoin, has now more or less doubled.

MicroStrategy’s unconventional treasury strategy, which involves converting cash reserves into Bitcoin puts the role of cryptocurrencies in corporate finance back in the center of the debate. Other corporate giants, such as Tesla and Square, have also allocated funds to Bitcoin.

For these companies Bitcoin acts as a hedge against inflation and currency devaluation.

About Microstrategy

MicroStrategy Incorporated is an American corporation that specializes in providing business intelligence (BI), mobile software, and cloud-based services. Established in 1989 by Michael Saylor, Sanju Bansal, and Thomas Spahr, the company focuses on developing software solutions for analyzing both internal and external data to facilitate informed business decisions and the creation of mobile applications. Headquartered in Tysons Corner, Virginia, within the Washington metropolitan area, it operates as a publicly traded entity.

Michael Saylor serves as the Executive Chairman, having previously held the position of CEO from 1989 until 2022. Noteworthy competitors include SAP AG Business Objects, IBM Cognos, and Oracle Corporation’s BI Platform.

With its substantial holdings of the cryptocurrency, MicroStrategy is widely recognized as a significant player in the Bitcoin market, often regarded as a proxy for the digital asset.

In August 2020 for instance MicroStrategy invested a whopping $250 million in Bitcoin, positioning it as a treasury reserve asset. The decision stemmed from concerns over diminishing returns from cash reserves, a weakening dollar, and broader global macroeconomic trends. This marked the beginning of a series of substantial Bitcoin purchases by the company.

By September 19, 2022, MicroStrategy and its subsidiaries had amassed approximately 130,000 Bitcoins, acquired at an aggregate purchase price of $3.98 billion, with an average cost of $30,639 per Bitcoin. Notably, during this period, the market price of Bitcoin hovered around $19,200. The driving force behind this strategic initiative was MicroStrategy’s CEO, Michael Saylor.

During the company’s quarterly earnings call on May 3, 2022, MicroStrategy’s CFO, Phong Le, revealed that the company would face a margin call if Bitcoin’s price fell to approximately $21,000. A margin call would necessitate the sale of some Bitcoin holdings to meet financial obligations. Le mentioned the possibility of injecting additional collateral into loans to mitigate such risks. Despite Bitcoin’s price dipping to about $20,800 in June 2022, MicroStrategy did not receive a margin call.

On December 22, 2022, MicroStrategy executed its first Bitcoin sale, disposing of 704 BTC for approximately $11.8 million.

Continuing its Bitcoin acquisition spree, MicroStrategy announced on September 25, 2023, that it had purchased approximately 5,445 Bitcoins for around $147.3 million in cash between August 1, 2023, and September 24, 2023. These acquisitions were made at an average price of approximately $27,053 per Bitcoin, inclusive of associated fees and expenses.

And now they added an extra $632 million to their portfolio next to the previous $1 billion.