What is Self-Custody in crypto? Here are the full details.

What is Self-Custody in crypto? Here are the full details.

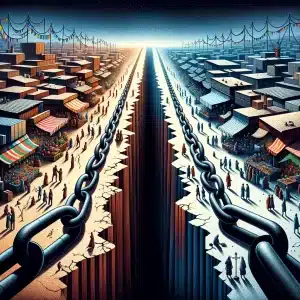

Self-custody in the context of cryptocurrency refers to the practice of individuals personally managing and securing their own digital assets, rather than relying on a third party, like a bank or a centralized exchange, to do so. This concept is central to the ethos of cryptocurrencies and blockchain technology, which emphasize decentralization and individual control.

Key aspects of self-custody in crypto include:

- Private Keys Management: In self-custody, you are solely responsible for managing the private keys associated with your cryptocurrency wallets. These private keys are crucial as they grant access to your crypto assets. Keeping them secure and accessible only to you is paramount.

- Full Control Over Funds: Self-custody gives you complete control over your cryptocurrency holdings. You can send, receive, and store cryptocurrencies without needing permission or intervention from any financial institution or third party.

- Security Responsibilities: With self-custody, the responsibility for the security of your digital assets rests entirely on you. This includes safeguarding against theft, loss, or unauthorized access. It involves practices like using hardware wallets, enabling multi-factor authentication, and maintaining backups of your private keys.

- No Third-Party Risks: By opting for self-custody, you avoid risks associated with third-party custodians, such as exchange hacks or the failure of a cryptocurrency service provider. However, this also means you don’t have the safety net that these institutions can provide, such as customer support or asset recovery in case of lost access.

- Privacy and Anonymity: Self-custody often allows for greater privacy since you don’t have to share personal information with a centralized service. Transactions can be conducted without linking them directly to your identity.

- Technical Knowledge: Managing your own crypto requires a certain level of technical knowledge. You need to understand how wallets work, how to perform transactions securely, and how to protect your keys from various threats.

- Irreversibility of Transactions: In a self-custody setup, there’s no intermediary to reverse a transaction if you make an error, like sending funds to the wrong address. It’s crucial to double-check all transaction details before confirming.

Self-custody empowers users with freedom and control over their digital assets but also demands a high level of personal responsibility, security awareness, and technical proficiency.

What is a self-custody wallet?

A self-custody wallet in the realm of cryptocurrencies is a type of digital wallet that allows users to store, manage, and control their own cryptocurrency assets without relying on a third-party service, such as a centralized exchange. Here are the key features and implications of using a self-custody wallet:

- Control of Private Keys:

- In a self-custody wallet, you have full control over your private keys, which are cryptographic keys that provide access to your cryptocurrency. This is akin to having the key to a safety deposit box; whoever holds the key controls the assets inside.

- Unlike wallets provided by exchanges or third-party services, where the service provider manages the keys, a self-custody wallet ensures that only you have access to these keys.

- Security and Responsibility:

- The security of your assets in a self-custody wallet depends entirely on how you manage and protect your private keys. If the keys are lost or stolen, there is no way to recover the funds, as there is no central authority or intermediary to turn to for help.

- It is essential to implement strong security measures, such as using hardware wallets (physical devices that store private keys securely), enabling two-factor authentication, and creating backups of your keys.

- Freedom from Third-Party Risks:

- Using a self-custody wallet means you are not exposed to risks associated with third-party custodians, such as the potential of an exchange being hacked, going bankrupt, or freezing your assets due to regulatory issues.

- However, this also means you don’t have access to the services that these platforms might offer, like dispute resolution, customer support, or assistance with forgotten passwords.

- Full Control Over Transactions:

- You have complete freedom to manage your cryptocurrency as you see fit, without needing approval from an external authority. This includes sending, receiving, and participating in various blockchain-based activities.

- This autonomy is a significant aspect of the decentralized ethos of cryptocurrencies, aligning with the principles of personal freedom and privacy.

- No Identity Verification:

- Self-custody wallets typically do not require you to undergo identity verification processes (KYC – Know Your Customer). This can be an advantage for those seeking privacy in their financial transactions.

- Ease of Use and Accessibility:

- Many self-custody wallets are designed to be user-friendly, with interfaces that make it easy to interact with various blockchain networks and decentralized applications (dApps).

- They can be accessed from anywhere, anytime, as long as you have the necessary credentials (like a seed phrase or password).

A self-custody wallet is a popular choice for users who prefer full autonomy over their cryptocurrency holdings and are comfortable with the associated responsibilities.