The Value of Bitcoin in an Era of Expanding Money Supply, a Very Complex Relationship

The Value of Bitcoin in an Era of Expanding Money Supply, a Very Complex Relationship

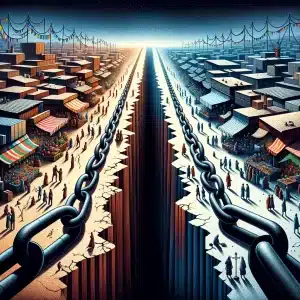

In the dynamic world of cryptocurrencies, Bitcoin has emerged as a frontrunner, intriguing investors and analysts alike. Its value, often perceived as enigmatic, seems to dance to a different tune than traditional financial assets. Particularly intriguing is its behavior in the context of an expanding money supply, a phenomenon characterized by central banks, like the U.S. Federal Reserve, increasing the amount of currency in circulation. This article delves into the multifaceted relationship between Bitcoin’s value and the printing of U.S. dollars.

1. Monetary Policy and Inflation Fears might influence the Bitcoin Value

The core of Bitcoin’s appeal lies in its limited supply – a stark contrast to traditional fiat currencies, which can be printed without limit. This characteristic has positioned Bitcoin as a potential hedge against inflation. When central banks opt to print more money, inflation fears escalate, and investors may gravitate towards assets like Bitcoin to safeguard their wealth. This shift in investment can result in an uptick in Bitcoin’s price, suggesting a correlation between its value and monetary expansion.

An industry expert from Seeking Alpha noted, “With a money supply that is ever expanding, a fixed amount of BTC will necessarily move higher in price… this is Bitcoin’s time to shine: Bitcoin is going higher.”

2. Investor Perception and Market Sentiment

Bitcoin’s reputation as the ‘digital gold’ has reinforced its status as a safe-haven asset. In times of economic uncertainty or aggressive monetary expansion, Bitcoin becomes a go-to asset for investors seeking stability outside the conventional financial system. This perception, albeit subjective, plays a pivotal role in driving its price. As articulated by a market analyst, “The money supply has me looking heavily into becoming an active trader… The culprit that will drive this is the money supply and what the US Government has just done to it.”

3. Liquidity and Speculative (Bitcoin) Trading

An increased money supply results in more liquidity within the market, part of which might flow into speculative assets like Bitcoin. This influx of capital, driven by both individual and institutional investors, has the potential to propel Bitcoin’s market value. Or as a report by S&P Global highlights, “QE fueled appetite for higher-risk assets… increased global liquidity/money supply… should also have a positive impact on the crypto market.”

4. Global Economic Factors

The Bitcoin market is not immune to global economic forces. Factors like regulatory changes, technological advancements, and geopolitical events can significantly impact its price. These factors, combined with monetary policies, create a complex web of influences that shape Bitcoin’s value.

5. Empirical Studies and Data Analysis

Establishing a concrete correlation between Bitcoin’s price and the printing of money necessitates rigorous empirical studies and data analysis. The relationship is intricate and not always predictable, varying over time and under different economic conditions.

Establishing a concrete correlation between Bitcoin’s price and the printing of money involves complex and multifaceted analyses, as evidenced by various empirical studies:

- A study found a two-way causality relationship between the cryptocurrency market and bond markets, indicating that changes in one could predict fluctuations in the other.

- Research on the effects of quantitative easing policies (a form of money printing) showed varying impacts on Bitcoin prices. These effects ranged from temporary positive impacts to long-term positive influences via the liquidity channel.

- The application of technical indices, such as Chaikin’s volatility indicator, has been suggested to predict Bitcoin returns, a task challenging to achieve using fundamental analyses alone.

- Bitcoin’s market reaction tends to be more sensitive to negative news than positive news, indicating that its market is still developing and subject to various influences.

- An investigation into the dynamic correlation between Bitcoin prices and the U.S. economic policy uncertainty index revealed a long-range cross-correlation, indicating a complex relationship influenced by multifaceted economic factors.

In short, it’s all very complex

Despite potential correlations, Bitcoin often demonstrates a degree of non-correlation with traditional financial markets and monetary policies. Its decentralized nature means that its market behavior can deviate from conventional asset classes, often reacting differently to economic stimuli.

The relationship between Bitcoin’s value and the expansion of the money supply is a tapestry of economic theories, market psychology, and global events. There is a potential correlation, however the unique nature of Bitcoin and the cryptocurrencymarket at large requite further study and analysis to understand these complex dynamics.