No surge Bitcoin price after SEC approval exchange-traded Bitcoin funds

No impact on Bitcoin price after SEC approval exchange-traded Bitcoin funds

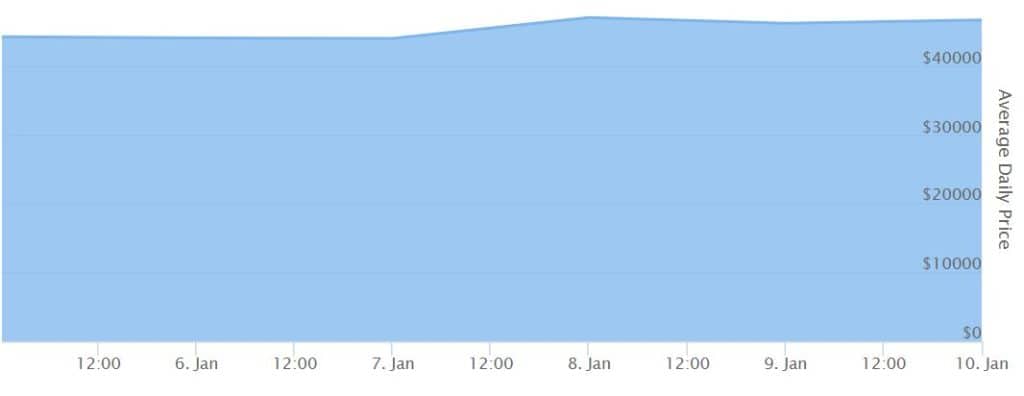

On Thursday, little movement was observed in the Bitcoin price. The much-anticipated approval by the U.S. Securities and Exchange Commission (SEC) for the introduction of exchange-traded Bitcoin funds was thus met with a lukewarm response from investors in the world’s largest cryptocurrency.

On Wednesday, it was announced by the regulator that approval had been granted for the introduction of exchange-traded Bitcoin funds, also known as Bitcoin ETFs. This decision makes the cryptocurrency more accessible to a broader group of investors. Investors are no longer required to purchase and store Bitcoins in a digital wallet. Instead, they are offered the opportunity to invest indirectly in Bitcoin.

Yesterday, the securities regulator approved the 19b-4 applications of ARK Invest & 21Shares, Bitwise, Invesco Galaxy, WisdomTree, Valkyrie, BlackRock, VanEck, Fidelity, Hashdex, Franklin Templeton, and Grayscale.

No Bitcoin endorsement after approval exchange-traded Bitcoin funds

“Although we have approved the listing and trading of certain Bitcoin ETFs, we have not approved or recommended Bitcoin itself,” SEC Chairman Gary Gensler stated in a declaration. “Investors should remain cautious regarding the numerous risks associated with Bitcoin and products whose value is linked to crypto.”

After the approval, Bitcoin’s price briefly surged to $47,000 but then quickly fell back, trading below $46,000 on Thursday morning. Experts believe the news of the Bitcoin ETFs‘ arrival had already been factored into the price.

On Tuesday, Bitcoin momentarily surged towards $48,000. This increase followed a false report on X, claiming the SEC had approved the Bitcoin ETFs. After the SEC soon clarified that this statement was incorrect, Bitcoin’s price fell back to around $45,000. Partly due to optimism about the potential introduction of exchange-traded Bitcoin funds, the cryptocurrency had already risen in value by about 160 percent over the past year.

Standard Chartered analysts earlier had said that the ETFs could draw $50bn to $100bn this year alone, potentially driving the price of bitcoin as high as $100,000. Others have said inflows will be closer to $55bn over five years.

Let’s see what the future brings.